Managing revenue churn by effectively pricing products is a critical challenge companies must navigate to ensure long-term success. The nuanced relationship between pricing strategies and customer retention is crucial, as these factors significantly impact a company's bottom line and its ability to sustain growth. This article delves into these topics, offering insights and ideas from the industry to help SaaS professionals tackle revenue churn through strategic pricing.

Understanding Revenue Churn

Revenue churn refers to the loss of revenue due to customers downgrading or leaving a service. It can be categorized into two types: voluntary and involuntary churn.

Voluntary Churn

This occurs when customers consciously decide not to renew their subscriptions or cease using a service, often influenced by pricing or perceived value.

Involuntary Churn

This happens passively, for reasons such as declined credit card transactions or changes in payment methods, without a direct decision to leave the service.

The Impact of Pricing on Churn

A typical customer conversation we find ourselves in is whether or not they should increase their prices. Why? A 1% improvement in pricing can lead to an 11% increase in profits, making it an exciting proposition for most companies.

However, one has to remember that pricing can be a pivotal factor in voluntary churn. A price increase may lead customers to perceive that the service is no longer worth its cost, prompting them to seek cheaper alternatives or discontinue usage. Conversely, if the service's perceived value increases commensurately with its price, the likelihood of churn should theoretically decrease. Maintaining this balance is delicate and requires careful management to ensure optimal customer retention.

It is also critical to understand that though pricing and churn can have a very strong relationship, the changes in one may have a delayed impact on the other. For instance, you may launch a price change at the beginning of the year, expecting to see some churn. However, once the first renewal cycle hits, you experience almost no churn. This might lead you to believe that your customers are not price-sensitive or that you were underpriced before (and that may be true!). But it could also be true that you have a very sticky product (i.e., your customers’ switching cost is very high), and thus, even though they knew a price increase was coming and would've wanted to churn, they couldn’t. At least not yet. You then see the churn the following year and wonder why when nothing really changed. This shows that the connection between pricing and churn can be, at times, hard to fully measure, and it is worth putting a bit of effort into doing so.

Deep Dive into Churn Mathematics

Understanding churn mathematics involves differentiating between positive and negative churn and quantifying the impact of pricing changes. Positive churn occurs when revenue from upgrades or additional purchases offsets the loss from churning customers, whereas negative churn signifies a net revenue loss.

Predicting Churn Through Pricing Changes

Analyzing the churn rate before and after a pricing adjustment helps assess the net revenue impact. Using historical data, predictive modeling forecasts how customer segments react, allowing companies to make informed decisions. You can also enhance this by running a pricing study before a price increase or running a pricing experiment on a subsection of your market to test the impact on churn.

Calculating Churn Impact

The net revenue impact calculation considers the churned customers and the additional revenue from those who stay, helping companies understand the overall effect of a price increase.

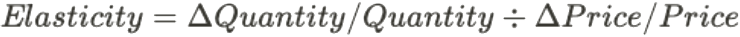

Moreover, the elasticity of demand for the product is crucial in predicting churn. Small price increases may lead to significant churn rates if the demand is elastic, indicating that customers are sensitive to price changes.

Finding the elasticity can be a complicated endeavor, and oftentimes, you will really only know it after a price change has occurred. This is why we often recommend price experiments to truly determine your customer’s price sensitivity. In lieu of experiments, pricing surveys can help you estimate the elasticity in your market and make a more informed decision.

Strategies to Manage Pricing and Reduce Churn

Transparent Communication

Clearly communicating the value at different pricing levels can mitigate churn. When you plan on making price changes, letting customers know how this will impact them and why the value they are getting justifies this is critical in ensuring minimal impact on churn. Netflix, for example, has successfully implemented price increases by enhancing its content library and streaming quality, justifying the higher costs.

Value Proposition Reinforcement

Continuously adding features that increase the product's utility, like Slack's ongoing addition of integrations, helps justify its pricing model. Ensure that you communicate this throughout the year and at the moment of a price change to drive home why the price and value are aligned. If the customer disagrees and churns, they may not be the right customer for you.

Segmented Pricing Strategies

Tailoring pricing and packages for different customer segments can help meet diverse needs, ensuring you deliver value to the right users/buyers. Value communication may also need to be different, as different segments may have different priorities.

Predictive Analysis and Customer Feedback

Churn prediction models and customer surveys can guide pricing adjustments, providing insights into how changes might affect retention. This is a critical step in understanding the impact of pricing changes and can help you and your customer plan ahead for how to handle its migration.

Gradual Price Increases

Adobe minimized backlash and churn by gradually transitioning users to its Creative Cloud subscription model, allowing customers to adjust to new pricing over time. This may take the form of discount structures that phase out or grandfathering.

Customer Success Initiatives

Investing in customer success ensures users achieve their desired outcomes with the product, helping justify subscription costs, as seen with HubSpot's extensive resources and support. A customer success team can also provide information on what to expect for specific accounts should you move forward with new pricing. Leveraging their knowledge of the customer base can be incredibly powerful.

Post-Churn Analysis

Exit interviews or surveys with churned customers can provide insights into how pricing influenced their decision to leave, informing future strategies. It also can ensure you know if pricing was the factor that drove the decision. Price changes will often bring people’s attention to products and their required spending, and though pricing is the catalyst, it may not be the actual reason customers churn (e.g., even price decreases can cause some churn!).

Migration Strategies

When adjusting pricing, SaaS companies must carefully plan migration strategies to transition existing customers to the new model with minimal friction. This involves clear communication, offering incentives or grandfathering plans, and conducting impact analyses to predict customer reactions. 2023 gave us both a great example (Gitlab) and a poor example (Unity, and how to lose $200M) of communicating and migrating your customers around a price change.

Some Key Tactics To Consider

We’re often asked what some of the best ways are to determine if a prospective price change will significantly impact churn. This article has briefly touched on a couple of our favorites, namely pricing research and experiments. It’s worth digging into both of those a little more in terms of when and how to use them.

Pricing Research

Most SaaS companies are familiar with various forms of customer research (i.e., UX studies, product interviews, churned customer surveys, etc.), but rarely do they leverage these avenues for connecting the information to their pricing. You can do pricing-specific research or include pricing-related topics/questions in existing research. With regard to churn, we would recommend having a three-pronged approach:

- Post-churn surveys: Ideally, these are constantly happening, and you merely need to add questions to understand if pricing was a factor. Ensure this isn’t binary but connects to feature usage or competitor offerings.

- Product experience surveys: if you are doing any form of in-app feedback requests, this can be a great place to understand how valuable people think your product is. If this starts trending down, you can likely expect churn to follow.

- In-take forms: most companies do some form of onboarding or in-take with their new customers, aiming to extract what the customer hopes to get out of the product/solution. Adding questions here to understand what impact they hope for or how this connects to their business outcomes can give you a sense of intent or the importance of your solution. Higher importance use-cases will likely face higher criticism, and higher levels of focus should be given to their usage of the product and overall adoption.

You can, of course, run a fully dedicated pricing study, which will cover a large number of topics (many of which can be relevant for churn). These tend to be done more ad-hoc with a particular business milestone (e.g., an upcoming new product release) and thus provide only point-in-time insights into churn. Nevertheless, if you are doing the research, it can be incredibly eye-opening!

Pricing Experimentation

Another option is to run live price experiments. This tends to be the slightly more complex or anxiety-inducing option (if you aren’t using tools like Corrily 😉). That said, if you are worried about how a price may impact things like conversion, churn, usage, etc., almost nothing compares to running an actual test.

Setting up specific price points you are interested in understanding, testing them in pilot or trial markets, and then monitoring for churn or LTV can be a game-changer over time to see how prices impact these things, as you can generally hold all else equal. In our experience, experiments are most valuable when they are run consistently throughout the year on specific subsets of customers, varying different aspects of your offering (e.g., prices, packages, etc.)

Conclusion

Pricing directly links to churn, which you ignore at your own peril. You can effectively manage customer retention and revenue optimization by integrating strategic pricing, pricing research and testing, and a thorough analysis of churn mathematics.

This holistic approach ensures that companies can mitigate risks associated with price adjustments and capitalize on opportunities to enhance customer value, ultimately leading to increased revenue stability and growth. As the industry continues to evolve, the ability to adapt pricing strategies in response to customer feedback and market dynamics will remain crucial for sustained success.