In the SaaS world, pricing and packaging (P&P) go together. Despite the key focus on how much to charge customers, a successful monetization model mainly focuses on how we charge our customers.

Packaging is key to SaaS monetization

Besides software monetization, my favorite pricing projects have been with national fast-food chains as a pricing consultant. For every chain, one of the first exercises we would conduct is to place an order by going through the menu board and analyzing the buying experience. Questions we would ask in the process:

- Could I understand the menu and offerings without any help?

- Was it easy and simple enough to find and order what I wanted?

- Did I end up ordering more than I initially planned?

- Was I encouraged to order something (e.g., desserts) that I initially had no desire for?

If you take a closer look, you will see that the menu board plays a pivotal role in driving sales for restaurants.

- Questions 1 & 2 tell us if the items and their respective values are demonstrated in a simplistic manner

- Question 3 tells us if there is a clear upsell path for different consumer segments

- Question 4 tells us if there is a natural cross-sell path for consumers to try out new items

You might be asking how this relates to software! Well, let's take a look at software packaging. Software packaging refers to the formation of features and functionalities into distinct blocks. The set of capabilities in an offer, except the price itself, constitutes a package. The goals for successful packaging are simple:

- Alignment with the overall value

- Simple for customers to understand, ensuring a frictionless buying experience

- A clear upsell path based on customer needs and willingness to pay

- A cross-sell path for separate products or services that can complement or enhance a customer's initial purchase

So, we can see that software packaging plays a similar role as a restaurant menu board in terms of driving sales. But unlike a restaurant transaction, a customer's revenue potential doesn't end at the point of sale. Applying the art of continuous upselling and cross-selling can help you grow the customer's account even after the initial purchase.

Just like a restaurant menu board, your SaaS packaging should be simple enough for customers to clearly understand the value proposition and different elements. They should be easily able to make the connection between your features and their associated utility. Crafting this well comes down to two key things: 1) Understanding your value metrics and 2) Aligning your P&P based on the value metrics.

Understand and identify your value metrics

Value in marketing, also known as Customer Perceived Value, is the difference between a prospective customer's evaluation of the benefits and costs of one product when compared with others.

In software, we can translate Benefits and Costs into tangible things. Benefits are the features you provide that coincide with jobs-to-be-done with your solution. And Costs are what users pay to get those benefits. Throughout their entire journey, customers are always doing some sort of cost-benefit analysis to measure the ROI.

A value metric is a single measure that strongly correlates with the value that a product creates for its customers. For a communication application like Slack, a value metric could be the number of messages sent. Products with at least one value metric grow 10 to 25% stronger, especially because of higher organic expansion revenue.

Different customers value different things, which causes them to value a particular product offering differently. Thus, understanding your customer segments becomes critical to making sure you have the right package construct aligned with the value metrics for each segment based on their needs and willingness to pay.

Value metrics should be used as a good proxy for the value being created by your product. It should naturally be one-directional so customers can easily follow. For example, customer data platforms (CDP) use the number of profiles (unique contacts) as the primary value metric. So, the more profiles you need to serve, the larger the package becomes.

If the plan is to use more than one value metric, they need to be MECE (mutually exclusive and collectively exhaustive). For example, a software platform can leverage two value metrics in its model for API calls: 1) Number of API calls; and 2) Amount of data transferred in each API call.

Here, the first metric correlates with the number of times an API call is made, and the second metric is tied to how much data is transferred in each of them. Thus, you pay more for more API calls with more data associated with them.

Best practices dictate that value metrics follow the following key principles:

- Clear connection with the value the customer receives from the product

- Grows over time, with your customer’s usage of that value driving growth

- Fluctuates little, not forcing customers to upgrade/downgrade regularly

- Correlates with the willingness-to-pay of customers

Leveraging value metrics for your Pricing & Packaging (P&P)

Based on value metrics, there are two practical ways to differentiate and craft the P&P of your SaaS solution:

- Features you provide

- Usage of your product/services

Feature-based differentiation and fixed subscription models

Historically, fixed subscriptions have been the go-to model for SaaS businesses. Feature-based value metrics offer the most predictability, which is critical for B2B buyers.

Fixed subscriptions are usually tiered based on their features and respective values. Companies target different customer segments by offering ‘Good, Better, Best’ options, each at a different price point and delivering different features and functionality. Customers choose their plan and pay the subscription price at regular intervals, irrespective of usage.

Here, customers don’t need to predict anything and can easily budget for the cost. This reduces the friction of the purchase considerably. When you have multiple predetermined plans, you can divide your customers into different segments and adapt your marketing and communication strategies to each of these segments.

However, this model does not always reflect the actual value users get. Less frequent users tend to pay more than they get in return, thus resulting in potential churn. On the other hand, heavy users tend to pay below the value they get. Another growing concern with heavy users is the potential cost-to-serve implications impacting margins.

Here is an example of feature-differentiated subscription-based pricing from Salesforce:

Usage-based differentiation and consumption/usage-based pricing models

Consumption pricing models have become more popular in recent years, as businesses have looked for ways to add more flexibility. This model removes price as a barrier to entry, as the price for usage is usually low. Leveraging this model, you can attract your first clients pretty quickly.

A consumption model means that rather than paying a fixed price for a product based on the capacity customers predict they will need, customers only pay for what they actually use. It is like a regular utility bill but for SaaS companies.

There are several different ways to set up and manage consumption models, including credit systems, pre-paid limits, and pay-as-you-go usage. Here, the value metric generally faces challenges in balancing simplicity, predictability, and transparency. It is critical to have the right systems and processes in place to help customers understand, track, and pay for their usage accurately.

In this model, your business's growth becomes highly dependent on your customer's success. Scaling is only possible if your customers’ businesses grow. This makes the functions of customer success and product stickiness more critical than in the past.

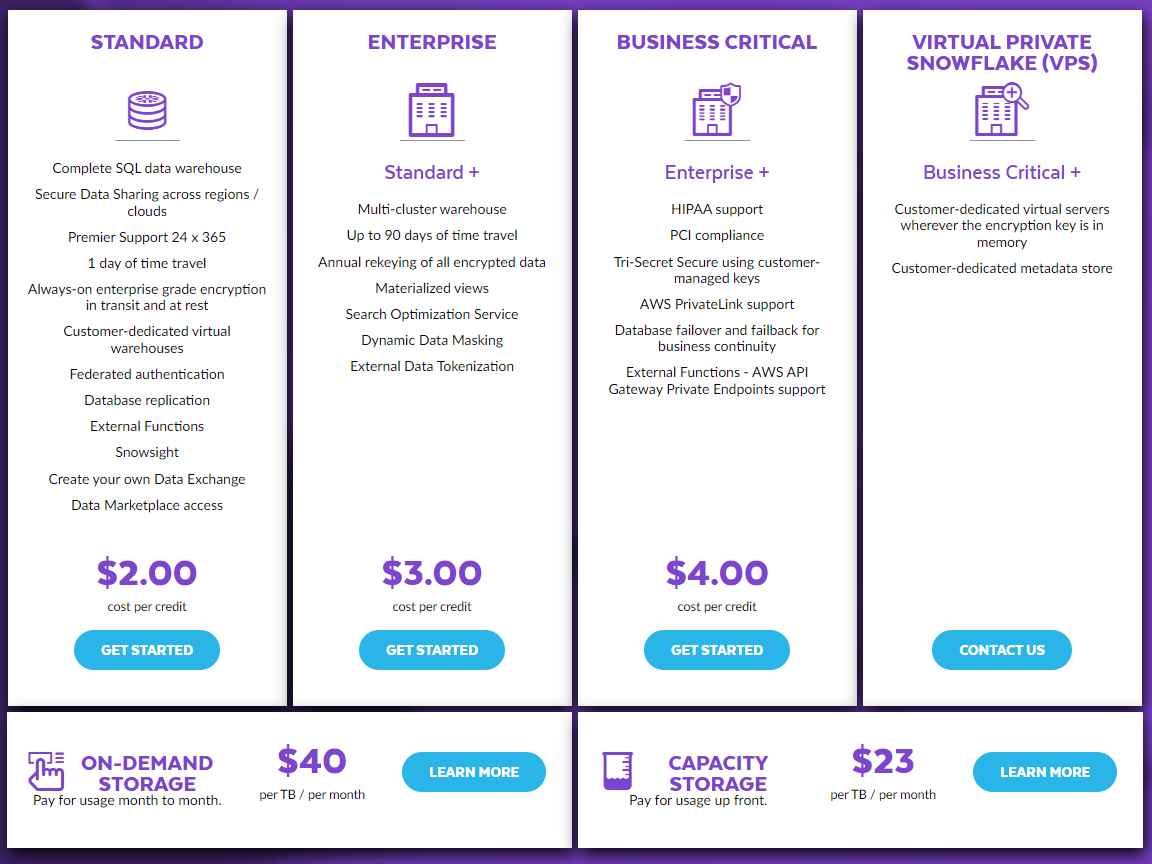

Here is an example of consumption-based pricing from Snowflake:

Despite its recent popularity, there are certain challenges with this model that need to be addressed to make it successful:

Challenge: Unpredictable revenue

Unlike fixed subscriptions, in consumption pricing, revenue is no longer predictable and has to be recognized completely differently. Oftentimes, it cannot be considered Annual Recurring Revenue (ARR) since it's not recurring predictably. ARR is often the most important metric for investors and executives, especially for funding rounds and IPO readiness.

Solution: Leverage customer usage data

Leveraging customer usage data to perform cohort analysis is the best approach. If done properly, cohort usage data ultimately aligns with actual usage and billing. As ARR is a measurement of ongoing customer usage, being able to segment usage across different customer cohorts helps you forecast this more accurately.

Challenge: Complex system/tool requirements

If there are prepaid limits set, then you have to figure out how to manage overages and underages - as this will almost always happen. This creates further system complexity and customer friction that many don't anticipate. Tracking this type of data and capturing it accurately is very difficult. The volume, diversity, and frequency of pricing vectors make this so complicated. Even with the emerging new tools and platforms to support this, it is still far from easy.

Solution: Analyze the tech stack

Analyze the tech stack you need to implement consumption pricing in-house. You can also consider UBP vendors for integrations, but carefully consider how the platform will fit within your existing software stack. In addition, you need to plan in detail for handling customer objections if/when they arise concerning usage transparency and billing.

Challenge: Risk of extreme seasonality

If you do consumption-based pricing and customers only pay for what they use, it's very easy for them to restrict usage when cash is tight, driving your revenue down to literally zero dollars. We observed this happen last year all across the tech space, with PLG-UBP companies hurting more than most due to churn and usage contraction.

Solution: Hybrid model

Many companies are using blended “Hybrid” models rather than purely subscription or consumption-based models. Our next section takes a deep dive into this topic.

Balancing both, the rise of “Hybrid” Models

Hybrid pricing is essentially a combination of subscription and consumption pricing models. Usually, companies will sell a subscription package with overlaid consumption elements. More adaptive than either pricing element alone, hybrid pricing models offer SaaS companies flexibility and a more predictable revenue stream while delivering value-based consumption that resonates with the market.

By combining a fixed subscription cost with consumption, hybrid pricing models provide customers with a predictable baseline cost while also allowing them to pay based on how much they use the product or service. This approach can be particularly appealing to customers who have fluctuating usage needs or who want to try out a solution before committing. On the flip side, this gives you all the right levers to achieve growth over time.

The recent pivot in the SaaS landscape from ‘growth at all costs’ to profitable growth – where top and bottom-line growth are balanced, indicates hybrid pricing models are becoming more popular. Hybrid pricing models enable companies to monetize outside of their core features and diversify revenue streams.

According to The State of Usage-based Pricing, Second Edition from OpenView Partners: “While 15% of SaaS companies have rolled out a largely usage-based or pay-as-you-go model, three times as many companies (46%) take a hybrid approach, either by testing usage-based pricing models alongside traditional subscriptions or offering a usage-based subscription plan.”

The report goes on to say that pure usage-based, or pay-as-you-go pricing has declined 22%-15%, while more complex, hybrid pricing models combining subscriptions and usage-based elements have gained traction.

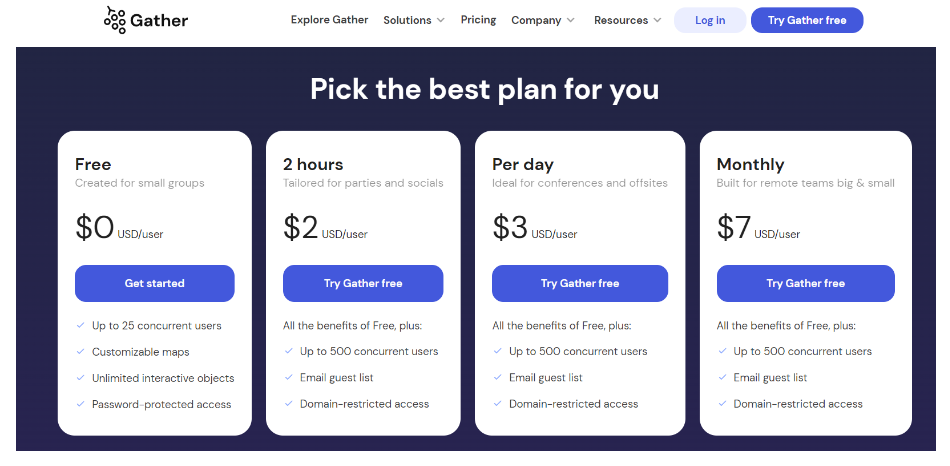

Below is an example of hybrid pricing from Gather. Gather provides a virtual environment for people to meet up or attend events. They have a basic freemium tier that is capped at 25 concurrent users. After that limit, all their plans can host up to 500 concurrent users. Their paid subscription plan is available monthly at a flat rate of $7 per user, but you can also purchase two-hour, or day passes for standalone events.

Conclusion

There is no holy grail in SaaS Monetization and crafting your P&P. It is not a one-time exercise but rather should be a continuous effort. As businesses scale and start to serve more customers, it’s wise to put processes in place that allow for the ongoing adaptation of pricing models.

For SaaS leaders, crafting the right monetization model offers an opportunity to get creative and take control of growth and profits. A thoroughly considered and regularly reviewed pricing strategy can do wonders for your business.

Your value metric should act as your north star through these changes. It’s critical to understand the spectrum of different pricing models and how they connect to your value metric. With an informed strategy in place, you can start to build out the teams, processes, and systems to support it.