Judging from the number of textbooks, conferences, essays, and armchair professors wholly devoted to the subject of pricing, you would expect an almost algorithmic level of sophistication in being able to answer any question. Regrettably, the most common answer SaaS companies will receive is the dreaded ‘it depends’.

SaaS companies typically start out in one of two camps: (1) underpricing their service given the lack of feasibility in the grander impact it can have or purely focusing on landing deals or (2) overpricing their offering due to the hubris they have with being able to solve the worlds’ problems.

Usually, in the first scenario, SaaS companies underprice their services and then the price set at the beginning tends to remain the same even as these companies evolve with new products and services. This inability to adjust to more recent market trends and growth leads to millions of dollars worth of profit annually being left on the table.

In the second scenario, companies flounder getting off the ground and wind up having to aggressively pivot or give major concessions in order to land their first deals.

Either way, these companies do not properly educate the market on the value they are providing and potentially anchor their product and price in the minds of their customers for years to come.

Thus the question looms, how do you price your product in a way that simultaneously helps you make a profit without alienating your customer base? Though a silver-bullet answer may just justify a Nobel prize, in the absence of that, market research, surveys, and price experimentation are some of the ways experts develop their pricing strategy.

Aiming to be tactical, the focus of this article will be price experimentation. We will discuss the benefits of carrying out a good price testing program, when to start, what you need for successful experimentation, and the pitfalls to avoid.

What is price experimentation?

Just like its name implies, price experimentation is all about carrying out tests and trying out different price points and feature mixes of your products to come up with a pricing strategy that aligns with what customers are willing to pay.

In a now-famous illustration by Richard Thaler, author of Misbehaving: The Making of Behavioural Economics, participants were asked to imagine themselves lying on a beach on a hot day with nothing but ice water to drink. They were then asked to state how much they were willing to pay for cold beer from a rundown convenience store versus a fancy resort hotel.

You would assume that the final figures would be about the same for both options since the product in question (beer) is also the same. However, Thaler discovered that participants were willing to pay more for beer sold in the hotel than in the store.

This experiment aligns with what William Poundstone opines in his book The Myth of Fair Value, “People tend to be clueless about prices. We don’t decide between A and B by consulting invisible price tags and purchasing the one that yields the higher utility. We make do with guesstimates and a vague recollection of what things are supposed to cost.”

Why should you experiment with your pricing?

Companies price their products differently depending on the stage they are in. Price experimentation is important for several reasons including coming up with a good pricing strategy, selling different product tiers, measuring demand elasticity, and pricing new products. Let’s look at each point in more detail.

To develop a good pricing strategy

Pricing is often seen as a terrifying field, as it can either be a massive lever for growth or the death knell in a company’s destruction. By simply changing their pricing, an OpenView research showed that 98% of SaaS companies saw an increase in revenue growth.

Netflix is a good example of this. Its pricing changes in 2017 led to a 10% increase in growth coupled with higher-than-projected subscriber growth and the astronomical rise of its stock. But it was not all smooth sailing for the streaming giant in the beginning. Way back in 2011, Netflix implemented a botched pricing strategy that saw it lose more than a million customers and have its stock decrease by almost 50%!

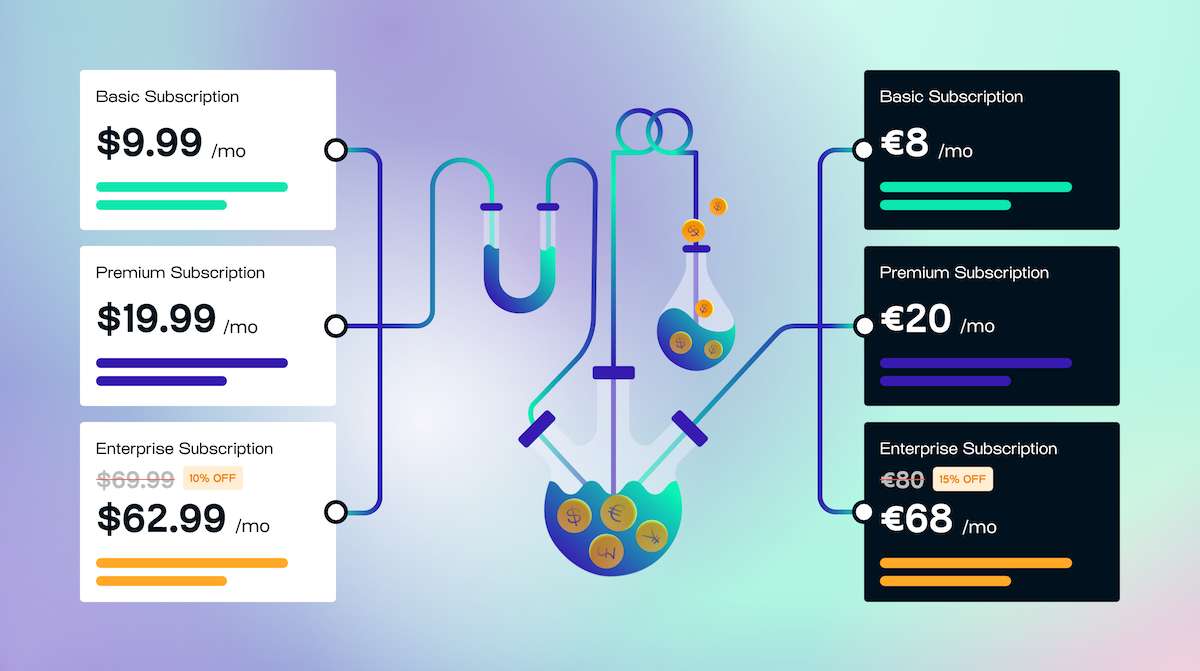

To sell different product tiers

SaaS companies typically offer their products in multiple tiers like Basic, Standard, and Premium to cater to different audiences. To come up with the prices for each tier without turning off customers can be done through price experimentation.

Using the anchor effect, for instance, you can come up with an effective pricing strategy to see which tier gives the most revenue. To illustrate, let’s assume you run a virtual assistant service offering three packages:

At $10.99, the Basic option allows for 5 requests

At $21.99, the Standard option allows for 10 requests

At $69.99, the Premium option allows for 20 requests

You can then test the prices to determine what your customer distribution will wind up being across your plans and thus identify the revenue optimal outcome, along with the profit optimal outcome given different plans may cost different amounts to provide. Additionally, you can also test the optimal number of “requests” (or whatever your value metric is) that you can provide under each plan.

To measure demand elasticity

Price experimentation is also ideal for determining demand elasticity which is how much a change in price affects demand. Is your product or service a necessity or luxury? Does your product stand out from your competitors? Is there a good substitute for your service? Will a customer consider it painful to part with your product? The elasticity of your product could tell you the answers to these questions.

A product is judged to be elastic if a subsequent fluctuation in price leads to a fall in demand. The reverse is the case with inelastic products as price fluctuations have little or no effect on their demand. For example, gas prices have been on the rise thanks to burgeoning inflation and other economic factors. This increase has however not led to a sharp drop in demand because gas is an essential part of modern society. In contrast, most common goods like coffee, TVs, toys, and regular cars are elastic.

So what does that tell you?

Understanding the elasticity of your product allows for more educated decision-making around your price and the resulting demand implication. Equipped with this knowledge, you'll know whether a price discrimination strategy is ideal or what price to set so you can maximize revenue or conversions. Most importantly, measuring demand elasticity enables you to better understand your customers’ willingness to pay.

To price new products

Settling on a price point for a new product can be difficult, especially in the absence of historical data that can provide needed insight. Thus, the data obtained during price experimentation can go a long way in determining the right price.

To give you an idea, let’s say a SaaS company is looking to introduce a new product into the market. However, there is a snag as the company is unsure of what pricing strategy to adopt. Should they cosmetically localize their product, meaning that they only change the currency symbol of their price, or do they do market localization and charge based on that country's purchasing power?

Through price testing, the company can gather information relating to the economic environment and guide it in determining what price won't alienate its new customers.

Disney+ used this strategy to cop market share for itself. Despite its heavyweight status, there was no guarantee that it was going to make a dent in an industry dominated by Netflix and Hulu. But through its penetration pricing strategy, Disney amassed a chunk of the market share by first offering customers a much lower price than its competitors. Now that they have successfully established themselves as a major market player, they are testing higher prices and new tiers.

When should you start price experimentation?

The perfect time to embark on price experimentation is whenever you are not sure of what would happen to your KPIs if you were to increase or decrease prices. Most companies don't know how their revenue would evolve if they were to raise prices by 20%. This is very problematic because it means these companies don't understand what value their users perceive from their product, and cannot measure how improvements have changed this value over time.

We believe that early-stage startups should go to the market as quickly as possible. At their stage, pricing has to be simple enough not to block usage. In addition, they should learn more about their users through surveys, interviews, live testing, etc. so they can improve their model over time.

Macro and microeconomic factors, sales activity, and seasonality should also be considered when deciding when to conduct a price test. In terms of market conditions, for highly seasonal businesses, it can be a good idea to run price testing and discount testing ahead of the holidays or periods of high activity. Testing during those times can be done if you have a large volume of customers. But there is usually so much going on during those times that you are better off doing the work in the off-seasons.

What you need to do before running a price experiment

By this time, you might be eager to jump head-first into experimentation. But hold on, as there are some boxes you need to check first if this is going to be beneficial to your business.

Define the goal/have well-defined metrics

- What do you hope to achieve with your price experimentation?

- Are you looking to widen your market share or increase revenue?

- Is your main concern revenue or margin growth?

Answering these questions, and other strategic questions beforehand will set you on a clearly defined path. Not doing so will create a lack of focus and risks endangering customer growth.

Get internal alignment/stakeholder buy-in

The topic of pricing, and thus price testing, remains a divisive one in many companies. Price is an emotional topic and many internal players will have an opinion. Yes, it has the potential for tremendous benefit but there is always a risk associated with live testing and it may also come with a cost in the short term. For instance, if your goal is to increase conversion, then expect a hit to your revenue and vice versa. These tradeoffs can seem too risky for some and either cause organizational tension or prevent tests from happening in the first place. This is why we advise that you not only aim for organizational alignment but that you ensure that all are aware of the goals and potential tradeoffs.

Set a baseline price

Once everyone is aligned, the next step is to determine an initial price to serve as your baseline. Your baseline price can simply be what you’re currently charging for your product, what research has told you might work, or what your gut might be telling you.

You will also need to determine the range of price points that you are willing to test. Your price points should ideally include both a minimum and maximum threshold. By having these in place, you’ll reduce any risk of making a mistake in your experiment as a result of wrong input data.

Start with new users only

The best practice is to start your experiment with prospects or new potential users. Your old customers already have the old price as a firm anchor from which they will form a biased opinion, thus muddying your experiment results.

Choose a pricing test method

There are a variety of methods you can use to carry out your experiment, and in this article we’ll discuss the two most common ones – A/B testing and Multi-armed bandit testing:

A/B testing

To do an A/B test, you will set your product at two different prices to gauge which one your potential customers prefer. You would then allocate equal website traffic to variants A and B and run the experiment. Whichever performs better is the ‘winner’ and what you would use moving forward. This is a great method when you have a small range to test from or you want to test more visual price testing elements.

Multi-armed bandit testing

An issue with classic A/B testing is that it evenly divides traffic between two variants and allows them to run for a period of time. The issue with this method is that traffic is still divided evenly between the variants even when there is a clear winner from the beginning. You only find this out at the end of the experiment, meaning you have missed out on valuable conversions throughout the experiment.

With multi-armed bandit testing, you can avoid this problem because it gives you a real-time update of the variants’ performance. If variant A is a clear winner by the third day of the one-week experiment, the multi-armed bandit algorithm will automatically direct more traffic to the winning variant so as to minimize any loss.

In essence, multi-armed bandit testing is a proven method that prevents your users from being exposed to low-performing variations.

Common mistakes to avoid when price experimenting

Now that you have gotten your price experimenting framework down, here are some mistakes to watch out for as you conduct your tests.

Collating negligible data

One common mistake during price testing is using too small a sample size or data volume to arrive at a conclusion. Given that the result is statistically insignificant, any decision based on such results could potentially be off the mark. Thus, it’s best to ensure that you have enough volume to get meaningful results from price experimentation - we recommend having at least 400 paid conversions a month.

Testing only once

Carrying out just one experiment won’t give you the whole picture. Repeatable experiments allow you to identify patterns and trends that you might have missed in your first experiment. In addition, you will be able to detect mistakes and falsifications that threaten the integrity of your data.

To get the best out of replication, ensure that the experiments are carried out under different conditions. For instance, if you’ve used the A/B testing method to test two price points – X and Y – and discovered that X generated more income, you could also try other variables like W and Z or Z and X to see if you get an improved result.

Ignoring your competitors

You are unlikely to be the pioneer in your field or operating in a monopoly. While it might be nice to have a monopoly advantage, leverage your competitors to give you an edge! You could charge more than your competitors to give users the perception that your service is of higher quality. Or lower your price at the beginning so you could capture market share. You could also opt for annual subscriptions if you notice everyone around you is offering monthly subscriptions. Whatever your strategy, use your competitors to stand out from the crowd.

Abandoning the experiment

You shouldn’t abandon an experiment just because it isn’t going as well as you envisioned. Apart from being a waste of time and resources, abandoning experiments halfway means the loss of valuable data that would have given you new insights. In summary, you should only consider an experiment a failure if it offers no new information.

On the flip side, desist from peeking at or continuously checking the results of your experiment with the intention of stopping it and making decisions based on the outcome. Abruptly stopping an experiment before it runs its course will only deliver false results with false precision.

Setting up your first price experiment

Price experimentation can be challenging for even the most prepared. A typical experiment involves sifting through tons of data and building a complex analytics engine with no guarantee that you will find what you are looking for. You also need to watch out for macro and microeconomic factors, such as inflation, currency fluctuations, market changes, and other similar parameters that can affect your price strategy.

Corrily uses live price experimentation to help you take the guesswork out of pricing. Live price experimentation has been heralded as the purest form of testing because users actually pay for the product instead of merely answering a survey or interview question, or going through a simulation.

Corroborating this claim, Australian unicorn Linktree says, “We just learned so much about our product in different markets with the authenticity of real users and real data. Previously, we'd surveyed creators and users in a pretty non-real (way). They were running through a survey and answering questions about what they were willing to pay for certain features kind of in a theoretical sense.

With Corrily, users have to put their money where their mouth is. So that's where we’ve learned the most.”